Property Division After Divorce in Quebec: Who Gets What?

Property Division After Divorce in Quebec: Who Gets What?

In Quebec, dividing property after a separation or divorce follows a structured process set out in the Civil Code. It is not about punishing one spouse or rewarding another, the goal is legal and economic fairness. The process has two stages:

- Dividing the family patrimony, a mandatory pool of assets created by law.

- Applying the matrimonial regime, which governs how other property is shared.

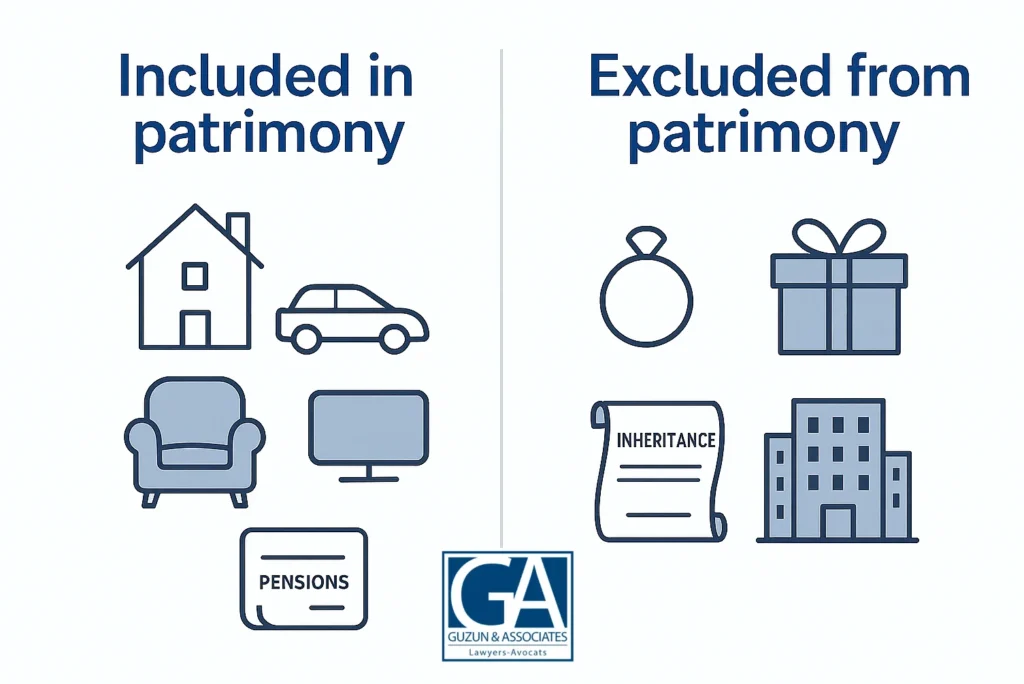

What Belongs to the Family Patrimony

The law clearly defines what assets form part of the family patrimony. These are typically the property and savings that supported the household during the marriage or civil union.

Typical inclusions:

- Family residences and rights to use them: principal home, cottage, or seasonal condo used by the family.

- Furniture and household items furnishing the family homes.

- Vehicles used for family transportation.

- Retirement savings and pensions accumulated during the marriage, including RRSPs and pension plan benefits.

Common exclusions:

- Personal items, such as jewelry or clothing.

- Property received as a gift or inheritance, including any increase in its value.

- Business or farm assets, except for the residential portion used by the family.

- Cash, bank accounts, and most non-retirement investments (with RRSPs as the exception).

Important scope notes:

- The patrimony applies to all married or civil-union spouses, regardless of whose name is on the title.

- Couples married before July 1, 1989 could opt out by declaration; those married after cannot.

- De facto (common-law) spouses are not covered, but since May 2025, Quebec has created a parental union patrimony for parents in a de facto union.

How the Value Is Divided

Courts generally split the net value of the patrimony equally. The process follows these steps:

- Fixing the valuation date. Usually, the date of filing the divorce application. In some cases, the separation or judgment date may apply.

- Determining market value. Homes are appraised, vehicles valued, and pensions calculated through plan administrators.

- Subtracting related debts. Mortgages, loans, or credit used to purchase, maintain, or improve patrimony assets are deducted.

- Partition of the net value. Each spouse is entitled to half the net patrimony. Equalization is often done through compensation payments rather than physically dividing every asset.

Lawyer’s insight: Disputes rarely arise over whether to split; they arise over how to value assets, which debts can be deducted, and whether something truly belongs in the patrimony. Detailed, contemporaneous documentation makes all the difference.

When Equal Division Can Change

While equal partition is the rule, Quebec law allows for exceptions. Courts may order unequal division only when strict equality would lead to clear economic injustice. Misconduct by itself is not enough, the imbalance must be financial.

If a spouse has dissipated patrimony assets shortly before proceedings, for example by cashing in RRSPs to avoid sharing, the court can adjust the partition or order compensatory payments.

Beyond the Patrimony: The Matrimonial Regime

Once the patrimony is settled, the rest of the couple’s assets and debts are divided according to their matrimonial regime.

- Partnership of acquests (default if there is no marriage contract): property is divided into private property and acquests, with acquests generally shared.

- Separation as to property: each spouse keeps their own property.

The patrimony applies regardless of regime. The matrimonial regime covers everything else businesses, investments, and other non-patrimony property.

What About Inheritances and Gifts?

Gifts and inheritances received by one spouse are excluded from the patrimony and usually remain private property. If, however, an inheritance was used to purchase the family residence, the residence itself is included in the patrimony, though deductions or compensation may apply.

Quick Reference: Included vs. Excluded

| Category | In the patrimony? | Notes |

| Family residences | Yes | Includes principal home, cottage, or seasonal condo |

| Furniture and household items | Yes | Furnishings and decor of family homes |

| Family vehicles | Yes | Cars used for family transportation |

| RRSPs and pensions accrued during marriage | Yes | Valued for the marriage period |

| Bank accounts, cash, non-retirement investments | No | RRSPs are the exception |

| Gifts and inheritances | No | Excluded, including any increase in value |

| Business or farm assets | No | Residential portion used by family can be included |

Practical Steps to Protect Your Interests

- Inventory and evidence. Keep records of titles, mortgage statements, RRSP and pension statements, and bills of sale.

- Independent valuations. Order appraisals for real estate, vehicles, and pension rights.

- Trace debts. Keep proof that loans were used to acquire or maintain patrimony property.

- Preserve assets. Avoid unplanned withdrawals or transfers. Courts can correct suspicious dissipation.

- Plan for the second layer. After patrimony, consider how your matrimonial regime applies to other property.

- Explore mediation. Many patrimony disputes are resolved through settlement and later approved by the court.

Special Note for De Facto Spouses

If you are not married or in a civil union, the marital patrimony rules do not apply. However, Quebec now recognizes a parental union patrimony for parents in de facto unions, with its own framework.

From Our Practice

We recently represented a client whose spouse proposed valuing the home months after separation, when the real estate market had dipped. By relying on the default filing date and obtaining a certified appraisal, along with deductions for necessary repairs, we secured a fairer equalization payment. The matter was resolved at mediation without trial.

Lawyer’s insight: Successful outcomes in patrimony cases are rarely about blame. They are about numbers, documentation, and clear legal strategy.

Conclusion: Plan Early, Document Well, Negotiate Smart

Property division in Quebec is guided by clear rules. The family patrimony is always split, and everything else is resolved under the matrimonial regime. The strongest cases are built on early preparation, solid documentation, and realistic negotiation.

At Guzun & Associates, we help clients in Montreal and across Quebec protect their interests and reach fair, durable agreements.

📞 Call us at +1 (514) 842-7414

📧 Email us at office@avocatguzun.com

📍 Meet us in Old Montreal or schedule a secure online consultation

With the right preparation, you can protect what matters most and approach divorce with clarity and confidence.